- Home

- News & Analysis

- GO Daily News

- Overnight on Wall Street: Thursday 12 November 2020

Overnight on Wall Street: Thursday 12 November 2020

November 11, 2020By Deepta Bolaky

@DeeptaGOMarkets

Equity Markets

The vaccines updates and daily counts of the coronavirus cases in major countries were the main drivers of risk sentiment on Wednesday. Overall, global equities managed to hold on to the recent gains.

Source: Bloomberg

In the US markets, the resurgence of the virus and more stay-at-home activities have triggered a rally in tech giants stocks due to their ability to service clients in a pandemic-induced environment.

Nasdaq Composite and S&P 500 rose in positive territory while the Dow lost ground in the final hours of trading after a struggling start:

- The Dow Jones Industrial Average lost 23 points or 0.1% to 29,398.

- S&P 500 rose by 27 points or 0.8% to 3,573.

- Nasdaq Composite added 233 points or 2.1% to 11,786.

Currency Markets

In the FX space, the price action was also driven by the same themes amid a public holiday in the US. Major currencies were mostly weaker against the US dollar but major pairs remained within familiar levels amid a lack of key drivers and a subdued economic calendar.

Source: Bloomberg

On the economic front, the most important event was the RBNZ Interest Rate Decision and Statement. Being one of the most dovish central banks, the RBNZ has started cutting interest rates earlier than its peers. As widely expected, the central bank kept the Official Cash Rate (OCR) at 0.25% with the following monetary stimulus:

- Maintain the existing LSAP programme of a maximum of $100b by June 2022; and

- Direct the Bank to implement an FLP in early December 2020.

Interestingly, even though a lower or negative OCR is still under consideration, the central bank noted that the economy has proved to be more resilient than expected and the likelihood of any changes to OCR will likely occur next year.

The NZDUSD pair got a boost and edged higher above the 0.68 level on a less-dovish RBNZ.

Source: GO MT4

Commodities

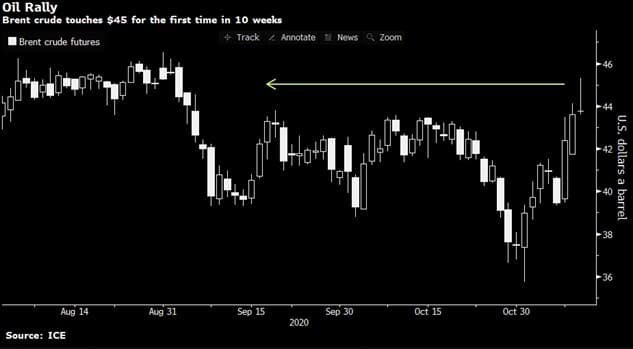

Crude oil prices continue to post gains on the back of the broad optimism in the markets and the positive vaccine news which have boosted hopes of the global oil demand recovery amid lockdown measures. Additionally, a bullish API report helped Brent Crude oil to trade momentarily around $45 level for the first time in 10 weeks as US crude oil supplies shrunk by more than 5.1 million barrels during the previous week.

As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $41.45 and $43.72 respectively.

Gold

Gold

The precious metal is being underpinned by the vaccine updates and the US Congress gridlock. The XAUUSD pair is also being pressurised by a stronger US dollar on Wednesday. As of writing, the XAUUSD pair is trading around $1,866.

Source: GO MT4

By Deepta Bolaky

Key upcoming events

- Consumer Inflation Expectations (Australia)

- BoJ’s Adachi Speech (Japan)

- FDI – Foreign Direct Investment (China)

- Manufacturing & Industrial Production, GDP and BoE’s Governor Bailey Speech (UK)

- Economic Bulletin and Industrial Production (Eurozone)

- Consumer Price Index, Jobless Claims, Fed’s Williams Speech and Monthly Budget Statement (US)

- BoC’s Wilkins Speech (Canada)

| Friday, 13 November 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 10.527 | 0.33 | 0.358 | 1.427 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: COTD: AUDUSD – Further Consolidation As Momentum Fades

Previous: Overnight on Wall Street: Wednesday 11 November 2020