- Home

- News & Analysis

- GO Daily News

- Today in Asia – 17 November 2020

Today in Asia – 17 November 2020

November 17, 2020By Deepta Bolaky

@DeeptaGOMarkets

Asian markets had a strong start to the week following the signing of the world’s largest free trade agreement by fifteen Asia-Pacific countries after more than eight years of tricky negotiations. The agreement binds together countries which make up of nearly a third of the world’s population or 30% of global gross domestic product (GDP).

On Tuesday, the Asia-Pacific region extended gains, buoyed by another pivotal vaccine moment which increases expectations that the coronavirus pandemic may soon come under control with a potential vaccine in the making. After Pfizer and BioNtech, Moderna Inc. announced that the Phase 3 study met the statistical criteria with a vaccine efficacy of 94.5%.

As of writing, the performance in the stock market in the Asia-Pacific region was mixed as major equity indices pared earlier gains.

World Equity Indices (% Change)

Source: Bloomberg

In the Australian share market, the S&P/ASX200 has resumed trading at the normal time at 10 am (AEST time) today after a market outage has forced the ASX to close earlier on Monday. The ASX200 closed in positive territory and added 0.2% or 14 points to 6,498 points. The sector performance was mixed with the energy index being the best performers following the positive vaccine updates.

Source: Bloomberg Terminal

Unibail Rodamco- Westfield, the real estate company which focus on large shopping centers rallied by 16.3% on Tuesday following more promising news on the vaccine front.

Source: Bloomberg Terminal

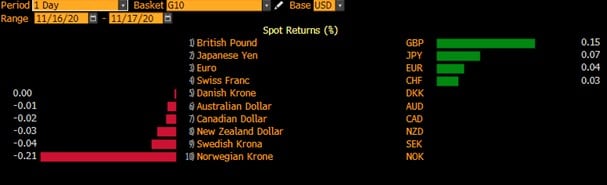

Currency Markets

There was little movement in the FX market. Major currencies were mixed against the US dollar and major pairs remained within familiar levels.

Source: Bloomberg Terminal

Oil Markets

Crude oil prices continue to climb higher on another positive vaccine news following Moderna’s announcement. Amid the current lockdowns and social distancing measures, the news on the vaccine fuelled the hopes of the global oil demand recovery outlook. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $41.66 and $44.21 respectively.

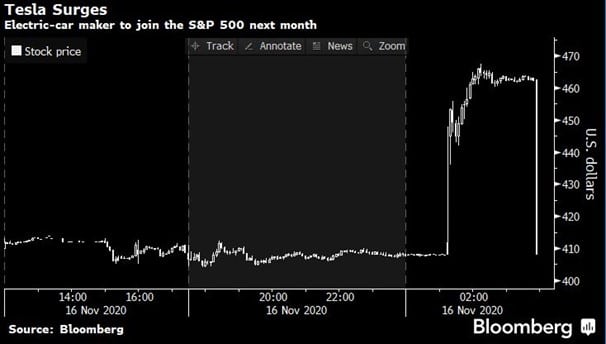

Other Notable News

The breaking news today was Tesla announcement to join the S&P500 on December 21. The electric-car maker’s share price rose by more than 11% in after-trading hours.

Looking Ahead

- BoE’s Governor Bailey Speech and Ramsden Speech (UK)

- Retail Sales, Industrial Production, and Fed’s Williams Speech (US)

- GDT Price Index (New Zealand)

- BoC’s Governor Macklem Speech (Canada)

By Deepta Bolaky

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Overnight on Wall Street: Wednesday 18 November 2020

Previous: COTD: AUDUSD – Further Consolidation As Momentum Fades