- Home

- News & Analysis

- Weekly Summaries

- COVID-19 Cases, Flash PMIs, Central Bank Minutes, and US Consumer Confidence & Black Friday Sales

COVID-19 Cases, Flash PMIs, Central Bank Minutes, and US Consumer Confidence & Black Friday Sales

November 23, 2020By Deepta Bolaky

As the world is heading into a holiday season still rattled by the widespread pandemic in major economies, it will be a shortened week for investors in observance of the Thanksgiving holiday in the US. The immediate attention will remain on the concerns on the virus front and the state of the global economy.

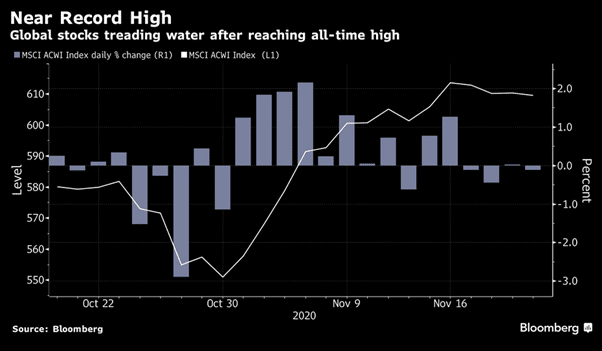

Equity markets

Amid rising coronavirus cases, stocks are poised for a muted start indicated by the subdued opening of index futures. The positive vaccine updates continue to be the supporting factor for investors amid the second wave of the outbreak where records of COVID-19 infections and deaths in some countries are at a daily high.

Vaccinations

On Friday, Pfizer and BioNTech SE submitted a request to the U.S. Food and Drug Administration (FDA) for Emergency Use Authorization (EUA) of their mRNA vaccine candidate, which will potentially enable the use of the vaccine in high-risk populations in the U.S. by the middle to end of December 2020.

They also announced their intention to roll submissions across the globe including in Australia, Canada, Europe, Japan and the U.K, and plan to submit applications immediately to other regulatory agencies around the world.

As per the announcement and Dr Moncef Slaoui, Americans could receive a COVID-19 vaccine as soon as the 11th of December. We expect investors to keep monitoring the progress of the submissions and more updates on the vaccine front.

US stimulus programs to expire

The US economy is in danger of facing a very challenging phase amid the stimulus gridlock, rising COVID-19 cases and the refusal of President Trump to coordinate transition efforts with President-elect Joe Biden. The US is heading into the Thanksgiving break without a stimulus deal and the threat of many stimulus programs expiring at the end of the year is looming.

Brexit

Even though the European Union appeared more optimistic around the negotiations with the UK, there is much uncertainty with countries like France and Belgium urging for the EU to also step up preparations of a no-deal Brexit. On the other side, the UK has struck a rollover trade deal with Canada to protect the flow of goods and services between the two countries after Brexit. Investors will likely continue to keep a close watch on the trade negotiations.

Key economic data to watch

Flash PMIs

After the rebound in activities, investors will likely analyse the PMI figures against the new lockdowns measures or social distancing restrictions seen recently. It will be interesting to see how the services and manufacturing sectors are performing amid fresh lockdowns.

US consumer confidence

The US Consumer Confidence index declined slightly in October, after a sharp V-Shaped recovery in earlier months. The Present Situation Index which is based on consumers’ assessment of current business and labour market conditions have increased from 98.9 to 104.6 last month but the Expectations Index which is based on consumers’ short-term outlook for income, business, and labour market conditions have decreased from 102.9 in September to 98.4 in October. This week’s Consumer Confidence will help to see how resilient consumer confidence is amid the lockdowns, stimulus gridlock and rising coronavirus cases.

Central bank minutes

The Fed and ECB minutes will be closely watched for more insights. The Fed minutes will stand out as it will be the first meeting after the US election and investors will be keen to see the interpretation of the election outcome from the Federal Reserve’s point of view.

Commodities

Oil

Crude oil prices were buoyed by vaccines updates and mixed weekly oil reports last week. Given the grim demand outlook, the vaccine updates provided some relief to the energy market. All eyes will now be on OPEC to control the supply side. The attention will also be on OPEC and its commitment to production cuts. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $42.44 and $45.10 respectively.

Gold

The precious metal remained depressed by the recent positive vaccine news and the gridlock in Washington despite the concerns on the virus front. As of writing, the XAUUSD pair is trading around $1,872. Traders will likely monitor COVID-19 updates, leading economic indicators and geopolitical events for fresh trading impetus.

Key events ahead

Monday

- Commonwealth Bank Services and Manufacturing PMI (Australia)

- Markit Manufacturing, Services and Composite PMI (Germany)

- Markit Manufacturing, Services and Composite PMI (Eurozone)

- Markit Manufacturing, and Services PMI, and BoE’s Haldane Speech (UK)

- Markit Manufacturing, Services and Composite PMI and Fed’s Daly Speech (US)

- BoC’s Gravelle Speech (Canada)

Tuesday

- Imports, Exports, Trade Balance and RBA’s Debelle speech (Australia)

- Gross Domestic Product and IFO – Business Climate, Current Assessment and Expectations (Germany)

- BoE’s Haskel Speech (UK)

- BoJ’s Governor Kuroda Speech (Japan)

- Housing Price Index, S&P/Case-Shiller Home Price Indices, Consumer Confidence and Fed’s Williams Speech US)

- RBNZ Financial Stability Report (New Zealand)

Wednesday

- RBNZ’s Governor Orr Speech (New Zealand)

- EU Financial Stability Review (Eurozone)

- ZEW Survey – Expectations (Switzerland)

- Durable Goods, Core PCE Expenditures, Personal Income and Spending, Jobless Claims, GDP, Michigan Consumer Sentiment Index, and New Home Sales (US)

- Autumn Forecast Statement (UK)

- Trade Balance, Exports and Imports (New Zealand)

Thursday

- Leading Economic Index (Japan)

- Gfk Consumer Confidence Survey (Germany)

- ECB Monetary Policy Meeting Accounts (Eurozone)

- ANZ – Roy Morgan Consumer Confidence (New Zealand)

Friday

- Consumer Price Index (Japan)

- Consumer Confidence and Business Climate (Eurozone)

By Deepta Bolaky

| Tuesday, 24 November 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0 | 0 | 0.052 | 0.08 | 0.056 | 0 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: NPF Week, Vaccine Updates, Brexit Deadline Looms and OPEC Meeting

Previous: Weekly Summary – Vaccine Updates and Rising Covid-19 Cases