- Home

- News & Analysis

- Weekly Summaries

- First vaccine approval, OPEC deal , Brexit & US stimulus hopes

First vaccine approval, OPEC deal , Brexit & US stimulus hopes

December 4, 2020By Deepta Bolaky

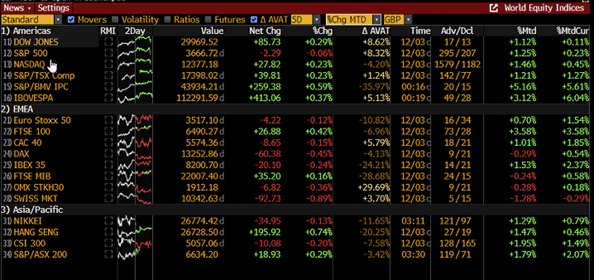

After a month-long rally in November which drove major equity indexes to record-highs, investors started the last month of the year with controversial vaccine approval and supply-chain issues.

Stock market – Vaccine updates

Global equities swung between losses and gains and major equity indices retreated from record highs as investors digested vaccine updates, stimulus talks and Brexit related news. In this devastating pandemic, investors welcomed the news of the first authorisation of a vaccine for COVID-19 despite the controversies around a hasty approval

Source: Bloomberg

Moderna announced that the primary efficacy analysis of the Phase 3 study of mRNA-1273 conducted on 196 cases confirms the high efficacy observed at the first interim analysis. The data analysis indicates a vaccine efficacy of 94.1%. Moderna requested clearance from the US and Europe regulators on Monday and the Company is expecting the VRBPAC meeting for mRNA-1273 likely on December 17, 2020.

Novavax, the biotechnology company carrying the COVID-19 vaccine program in the UK completed enrollment of 15,000 participants in a pivotal Phase 3 clinical trial being conducted in the U.K. to determine efficacy and safety of NVX-CoV2373.

Most importantly, Pfizer and BioNtech received their first authorisation from the UK regulator. The MHRA authorizes supply of COVID-19 mRNA vaccine for emergency supply under Regulation 174; Companies are ready to deliver the first doses to the U.K. immediately. The companies previously signed an agreement to supply a total of 40 million doses to the U.K. with delivery in 2020 and 2021.

The UK index rallied on the vaccine approval as The UK is officially the first country in the world to provide its approval for a COVID-19 vaccine which will likely be made available to care home staff and residents within the next couple of days. As of writing, the index has climbed by more than 3% since the beginning of the week and is trading at 6,463.20 pts.

Source: Bloomberg

On Thursday, the global stock market traded mixed following headlines that Pfizer is facing supply-chain issues and would only be in a position to deliver half of 2020 supplies.

Forex Market

In the forex market, the G10 currencies remained stronger than the US dollar. Major currencies pairs climbed to fresh 2020 highs mostly on the back of the dollar weakness.

Source: Bloomberg

US Dollar drop

The US dollar continues to struggle against its peers this week following fresh daily records on the virus front, mixed economic data, and on-and-off stimulus talks.

On the economic front, investors digested the mixed data against the back-and-forth on stimulus. A timely relief package may help the US to avoid more economic grief in the coming months.

- Chicago purchasing manufacturing index: The index came below expectations (59) in November: Actual (58.2).

- Pending home sales: A leading indicator of housing activity contracted by 1.1%. Contract activity was mixed among the four major U.S. regions, with the only positive month-over-month growth happening in the South, although each region achieved year-over-year gains in pending home sales transactions.

- ADP employment: Private sector employment was softer than expected in November. ADP Employment Change came at 307K below the expectations of 410K in November.

- Jobless claims: In the week ending November 28, the advance figure for seasonally adjusted initial claims was 712,000, a decrease of 75,000 from the previous week’s revised level.

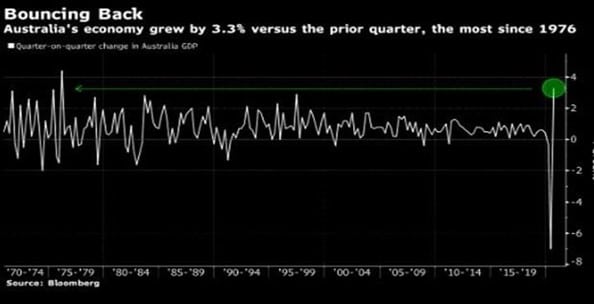

Aussie Dollar – Third-quarter bounce

As COVID-19 related restrictions eased across most states and territories to the exception of Melbourne which is Australia’s the second most-populated and largest city, the Australian economy emerged from a recession and rose 3.3% in the September quarter. The GDP figures came above expectations of a 2.5% growth. Given the havoc created by the pandemic, the level of economic activity still remains low and GDP has declined by 3.8% in the year to September 2020.

However, given that Melbourne which was the only state to record a fall driven by declines in household spending and investment has now eased restrictions, policymakers are expecting the economy to continue to grow in the fourth quarter, unlike some other major economies which are still battling a second wave of the outbreak.

As of writing, the AUDUSD pair is trading firmer above the key level of 0.74 at a new 2020 high.

British Pound – Brexit hopes

Amid a relatively muted economic calendar, Brexit hopes continue to be the main factor driving the Pound to the upside ahead of the looming deadline. As of writing, the GBPUSD pair is trading just below the 1.35 level.

The EURUSD pair also gained upside momentum lifted by some upbeat economic data and a weaker US dollar.

Germany retail sales: In October 2020, the turnover in retail rose by 8.2% (real) and 9.4% (nominal) compared to the same month of the previous year. In comparison to February 2020, the month before the outbreak of Covid 19 in Germany, the turnover in October 2020 was 5.9% (in real terms, calendar and seasonally adjusted) higher.

Eurozone retail sales: In October 2020, the seasonally adjusted volume of retail trade rose by 1.5% in both the euro area and the EU, compared with September 2020. In September 2020, the retail trade volume fell by 1.7% in the euro area and by 1.3% in the EU.

Oil market

After trading within familiar levels, crude oil prices were buoyed by the compromise OPEC deal despite bearish weekly oil reports:

- The United States EIA Crude Oil Stocks Change registered at -0.679M above expectations (-2.358M) on November 27.

- API reported a much larger-than-expected inventory level of 4.146M.

The 12th OPEC and non-OPEC Ministerial Meeting conclude positively where the OPEC and allies reaffirmed their commitment to a stable market. In light of the current oil market fundamentals and the outlook for 2021, the Meeting agreed to reconfirm the existing commitment under the DoC decision from 12 April 2020, then amended in June and September 2020, to gradually return 2 mb/d, given consideration to market conditions.

Beginning in January 2021, DoC participating countries decided to voluntarily adjust production by 0.5 mb/d from 7.7 mb/d to 7.2 mb/d. As of writing, WTI Crude oil (Nymex) and Brent Crude (ICE) were trading at around $45.86 and $48.95 respectively.

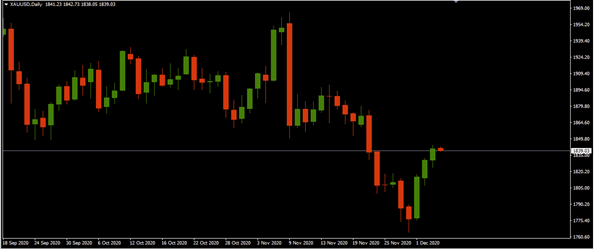

Gold

The precious metal reclaimed the key level of $1,800 following stimulus talks. As of writing, the XAUUSD pair was trading around $1,836.

Source: GO MT4

Key Upcoming Events

- Factory Orders (Germany)

- Nonfarm Payrolls, Trade Balance, Average Earnings, Labor Force Participation Rate, Underemployment Rate, Unemployment Rate and Factory Orders (US)

- Unemployment Rate, Participation Rate, Hourly Wages and Net Change in Employment (Canada)

By Deepta Bolaky

| Monday, 07 December 2020 Indicative Index Dividends Dividends are in Points |

||||||

| ASX200 | WS30 | US500 | US2000 | NDX100 | CAC40 | STOXX50 |

| 0.037 | 0 | 0.005 | 0.033 | 0.043 | 3.278 | 0 |

| ESP35 | ITA40 | FTSE100 | DAX30 | HK50 | JP225 | INDIA50 |

| 1.443 | 0 | 0 | 0 | 0 | 0 | 0 |

Disclaimer: The articles are from GO Markets analysts, based on their independent analysis or personal experiences. Views or opinions or trading styles expressed are of their own; should not be taken as either representative of or shared by GO Markets. Advice (if any), are of a ‘general’ nature and not based on your personal objectives, financial situation or needs. You should therefore consider how appropriate the advice (if any) is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next: Vaccine distribution, ECB, EU Summit, Brexit, and US stimulus talks

Previous: NPF Week, Vaccine Updates, Brexit Deadline Looms and OPEC Meeting